Two Reasons Why Today’s Housing Market Isn't a Bubble

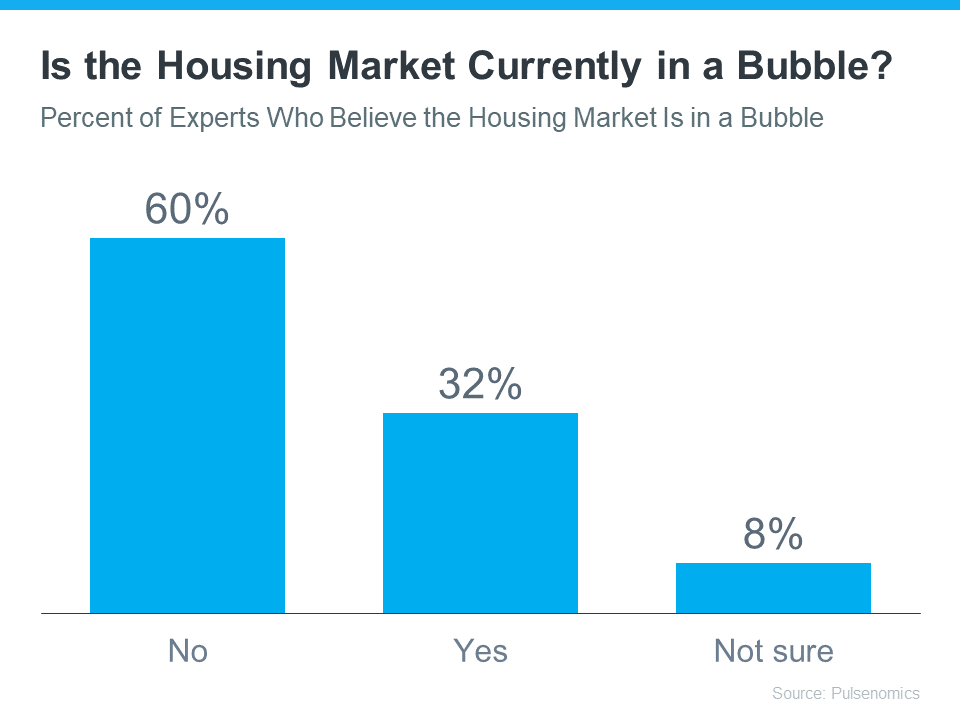

It's crucial to realize that the data and professional perspectives paint a different picture from the headlines and talk about a possible housing bubble or crash. In a recent study, Pulsenomics asked more than 100 real estate economists and housing market specialists if they thought the home market was in a bubble. The findings show that, according to the majority of experts (see graph below):

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

As the graph shows, a strong majority (60%) said the real estate market is not currently in a bubble. In the same survey, experts give the following reasons why this isn’t like 2008:

- The recent growth in home prices is because of demographics and low inventory

- Credit risks are low because underwriting and lending standards are sound

If you’re concerned a crash may be coming, here’s a deep dive into those two key factors that should help ease your concerns.

1. Low Housing Inventory Is Causing Home Prices To Rise

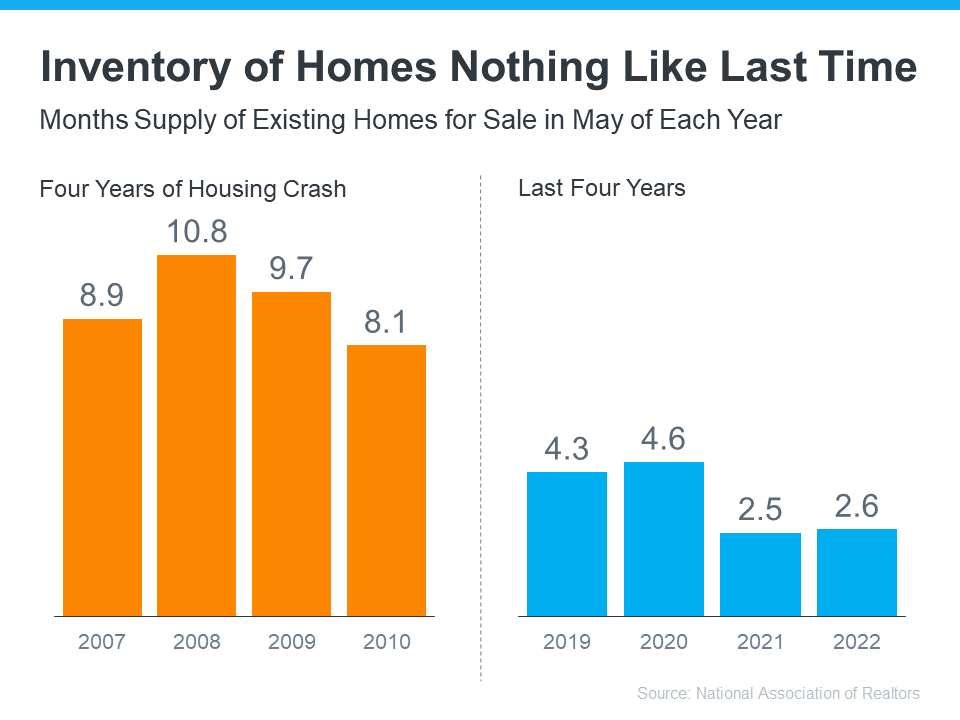

About six months' worth of housing inventory is required to maintain a typical real estate market. Anything more than that is considered an excess and will result in falling pricing. Anything less than that creates a shortage and will cause prices to rise further.

The graph below demonstrates how the oversupply of homes for sale between 2007 and 2010—many of which were short sales and foreclosures—led to a decline in home values. Since there is still a lack of available inventory, housing prices are continuing to rise (see graph below):

Nothing about inventory is the same as before. Prices are growing as a result of a strong desire for homeownership and a constrained supply of available properties. Odeta Kushi, First American's deputy chief economist, explains:

“The fundamentals driving house price growth in the U.S. remain intact. . . . The demand for homes continues to exceed the supply of homes for sale, which is keeping house price growth high.”

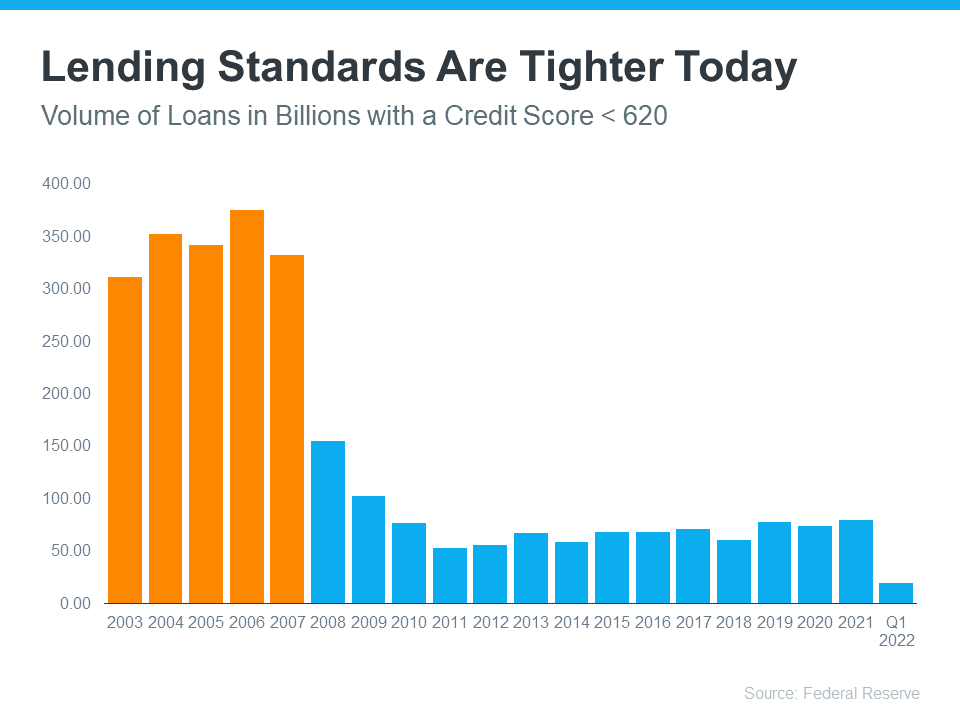

2. Mortgage Lending Standards Today Are Nothing Like the Last Time

Mortgage approval was considerably simpler than it is now during the housing bubble. Here is a graph comparing the number of mortgages given out to buyers with credit scores less 620 during the housing boom to the volume given out in the years that followed:

This graph demonstrates one reason why mortgage rules today differ significantly from those of the past. Compared to the years prior to the crash, buyers who obtained a mortgage in the last ten years are substantially more qualified. Realtor.com notes:

“. . . Lenders are giving mortgages only to the most qualified borrowers. These buyers are less likely to wind up in foreclosure.”