The Drop in Mortgage Rates Brings Good News for Homebuyers

Harry Kimbrough

Tuesday, July 12, 2022

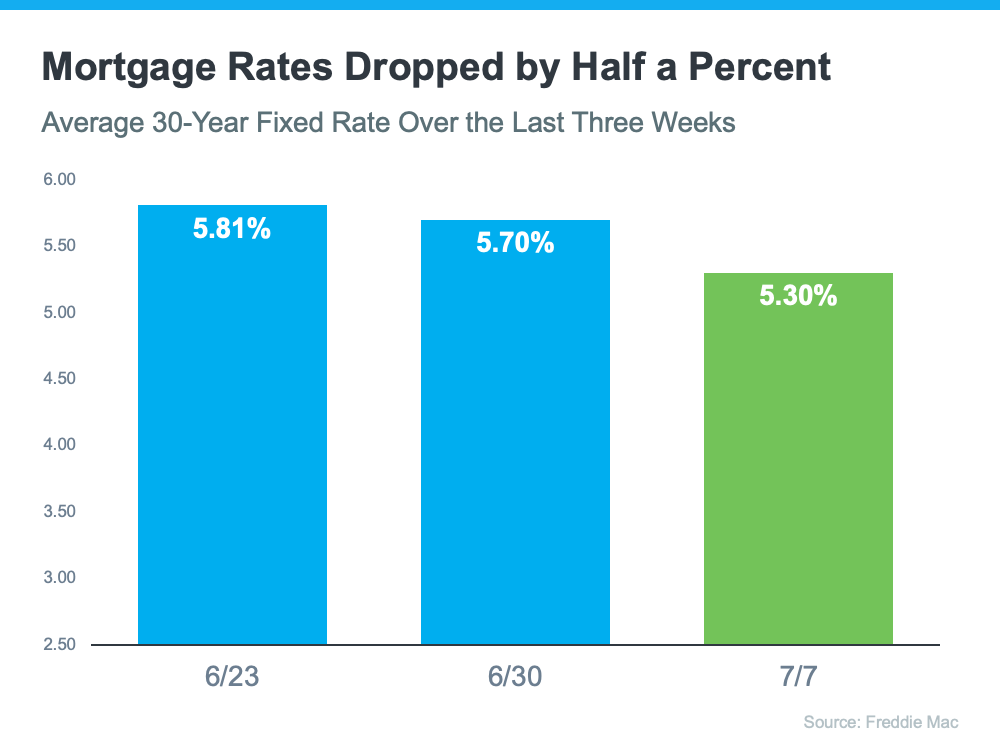

The typical 30-year fixed mortgage rate from Freddie Mac decreased by 0.5 percent over the last several weeks. Fears of a possible recession led to the decline. Homebuyers around the nation should cheer this drop because mortgage rates have climbed sharply this year.

According to Freddie Mac, the average 30-year rate dropped from 5.81 percent two weeks earlier to 5.30 percent today (see graph below): Why, however, is this most recent decline such excellent news for homebuyers? The National Association of Realtors' (NAR) Senior Economist and Director of Forecasting Nadia Evangelou explains:

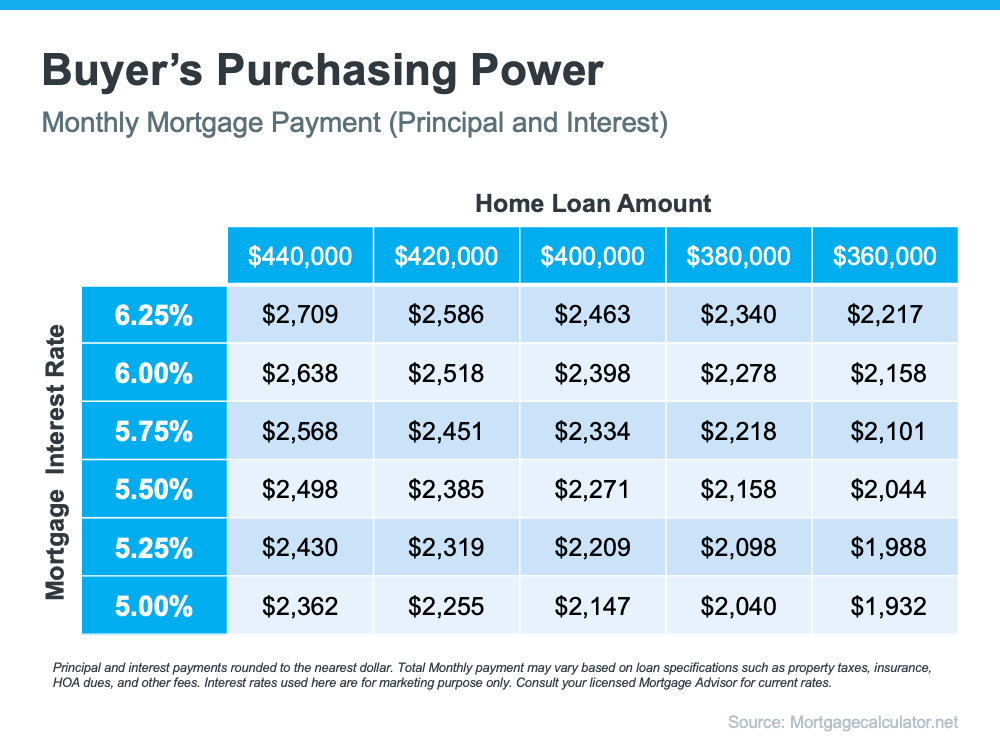

That's because rising interest rates effect how much you'll pay in monthly mortgage payments, which directly affects how much you can comfortably afford (as they have for the bulk of this year). The opposite is also accurate. Your purchasing power will improve when mortgage rates decline.

The graph below illustrates how a change in mortgage rates of half a point, or even quarter of a point, might affect your monthly payment:

According to Freddie Mac, the average 30-year rate dropped from 5.81 percent two weeks earlier to 5.30 percent today (see graph below): Why, however, is this most recent decline such excellent news for homebuyers? The National Association of Realtors' (NAR) Senior Economist and Director of Forecasting Nadia Evangelou explains:

“According to Freddie Mac, the 30-year fixed mortgage rate dropped sharply by 40 basis points to 5.3 percent. . . . As a result, home buying is about 5 percent more affordable than a week ago. This translates to about $100 less every month on a mortgage payment.”

That's because rising interest rates effect how much you'll pay in monthly mortgage payments, which directly affects how much you can comfortably afford (as they have for the bulk of this year). The opposite is also accurate. Your purchasing power will improve when mortgage rates decline.

The graph below illustrates how a change in mortgage rates of half a point, or even quarter of a point, might affect your monthly payment:

We would like to hear from you! If you have any questions, please do not hesitate to contact us. We are always looking forward to hearing from you! We will do our best to reply to you within 24 hours !